News

Understanding DXC’s Power BI Application Support

Published

6 months agoon

By

Anderson

Power BI is a powerful tool for businesses that helps them visualize and analyze data. DXC Technology offers specialized Power BI application support to ensure businesses get the most out of this tool. With their professional services, you can optimize your data analysis and improve decision-making. This article will explore what DXC’s Power BI Application Support is all about and how it can help businesses enhance their operations.

What is DXC’s Power BI Application Support?

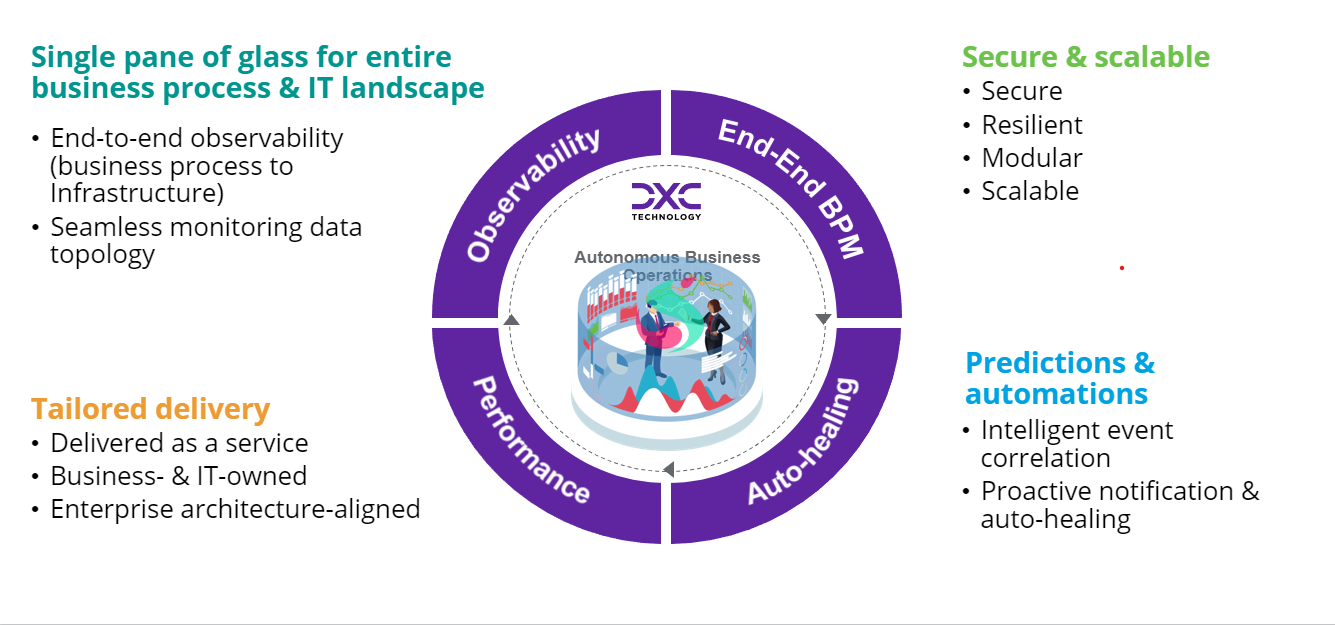

DXC Technology provides application support for Power BI, a widely used data visualization and business intelligence tool. Their support services are designed to help businesses implement, configure, and maintain Power BI applications seamlessly. They offer expertise in building dashboards, generating reports, and setting up Power BI environments that can process large volumes of data effectively.

DXC’s team of professionals helps businesses manage the complexities of integrating Power BI into their systems. Whether it’s configuring security features, optimizing performance, or providing ongoing assistance, DXC ensures businesses can harness the full power of Power BI to drive their data strategies.

Key Features of DXC’s Power BI Support

DXC’s Power BI application support offers a range of services that cover every aspect of working with Power BI. These include:

- Customized Solutions: DXC offers tailored Power BI solutions to meet the specific needs of your business.

- Technical Expertise: With skilled professionals, DXC ensures that your Power BI environment runs smoothly and efficiently.

- Performance Optimization: DXC focuses on optimizing Power BI performance to ensure quick and accurate data processing, even with large datasets.

By choosing DXC, businesses can access comprehensive support that covers setup, maintenance, training, and troubleshooting, ensuring smooth operations.

Setup and Configuration

Setting up and configuring Power BI can be challenging without the right expertise. DXC’s Power BI application support team guides businesses through the entire process, from installation to full configuration. They help with setting up Power BI workspaces, configuring security settings, and connecting Power BI to data sources, making sure everything runs as it should.

Custom Report Creation

Creating custom reports is one of the most valuable features of Power BI. DXC’s support team helps businesses design and implement custom reports that align with their specific data analysis needs. This service ensures businesses can visualize their data in the way that makes the most sense for their objectives.

Ongoing Assistance

DXC’s support doesn’t end after the initial setup. They offer ongoing assistance to ensure businesses continue to make the most of their Power BI applications. Whether it’s troubleshooting issues, updating systems, or offering advice on best practices, DXC provides continuous support that businesses can rely on.

Benefits of Choosing DXC for Power BI Support

Choosing DXC for Power BI support offers several advantages:

- Expert Knowledge: With their vast experience, DXC ensures your Power BI applications are running optimally.

- Customized Solutions: DXC understands that every business has unique needs and offers tailored solutions to fit those needs.

- 24/7 Support: With round-the-clock assistance, DXC ensures that businesses have the help they need whenever they need it.

By partnering with DXC, businesses can optimize their Power BI solutions, boost productivity, and enhance data-driven decision-making.

Enhance Data Analysis

One of the primary goals of Power BI is to enhance data analysis. With DXC’s Power BI support, businesses can effectively analyze large volumes of data. By providing expert guidance, DXC ensures that businesses can turn their raw data into meaningful insights that drive their business strategies forward.

Improve Decision-Making

Power BI’s data visualization capabilities help businesses make better decisions. With DXC’s support, businesses can ensure they’re using Power BI to its full potential. The insights derived from accurate data analysis help businesses make informed decisions that can lead to improved efficiency and profitability.

Ensure Smooth Operations

For businesses to stay competitive, smooth operations are crucial. DXC’s Power BI support helps ensure that Power BI tools and applications work seamlessly. By providing regular updates, troubleshooting, and performance optimization, DXC ensures that businesses experience minimal downtime and maximum productivity.

How DXC’s Support Helps Your Business

With DXC’s Power BI support, businesses benefit from several key services:

- Expert Advice: The team at DXC provides valuable advice on how to best utilize Power BI for your business needs.

- Faster Troubleshooting: When issues arise, DXC helps resolve them quickly, minimizing disruptions to business operations.

- Training and Resources: DXC also offers training resources to help your team become proficient in using Power BI effectively.

Streamlining Data Processes

DXC’s support ensures that businesses can streamline their data processes. They help businesses integrate Power BI with their existing data systems, making it easier to access and analyze data. This streamlining of processes can save time, improve data accuracy, and lead to more informed decision-making.

Providing Expert Guidance

DXC’s team provides expert guidance on using Power BI to its fullest potential. They help businesses implement best practices, optimize performance, and resolve technical issues, ensuring that Power BI is a valuable asset to the business.

Getting Started with DXC’s Power BI Support

Getting started with DXC’s Power BI support is simple. First, businesses need to reach out to DXC for a consultation. The team will assess the business’s needs and recommend a tailored solution. From there, DXC will assist with the setup, configuration, and ongoing support, ensuring a smooth Power BI experience.

The Bottom Line

In today’s data-driven world, businesses need reliable tools like Power BI to make informed decisions. With DXC’s expert application support, businesses can optimize their use of Power BI, streamline their data processes, and improve overall performance. By offering customized solutions, expert guidance, and ongoing support, DXC ensures businesses can stay ahead of the competition and drive better outcomes.

You may like

Cheata is a small, peaceful town in the United States that many people haven’t heard about yet—but it’s starting to become more popular. Families love Cheata for its quiet streets, kind neighbors, beautiful nature, and easy way of life. In this guide, we’ll explore what makes Cheata such a special place.

Where Is Cheata in the United States?

Cheata is located in the heart of the United States. While it might not appear on every map, this small town is tucked away between rolling hills and peaceful rivers. The nearest big city is just a short drive away, making Cheata both quiet and convenient.

This little town sits in a rural part of the country, where nature is untouched and the air is fresh. Most people drive to Cheata, and many enjoy the scenic views on the way. The location is perfect for anyone who wants to escape busy cities without going too far.

What Makes Cheata a Special Place?

Cheata is more than just a dot on the map. It’s a community where people greet you with a smile, where kids play safely outdoors, and where neighbors truly know each other. Unlike large cities that feel crowded and noisy, Cheata feels like home. The fresh air, friendly people, and slow pace make it ideal for families, retirees, and anyone looking for peace.

One thing that makes Cheata stand out is its connection to nature. The town is surrounded by forests, fields, and lakes. You’ll find trails to explore, birds to watch, and starry skies at night. People here enjoy simple living—gardening, fishing, hiking, and spending time with loved ones.

Fun Things to Do in Cheata

While Cheata may be small, it’s full of fun things to do. Whether you’re an outdoor lover, a history buff, or someone who just wants to relax, you’ll find something you enjoy.

Go on a Nature Walk

Cheata is known for its quiet walking trails and beautiful parks. You can walk through wooded paths, listen to birds sing, and breathe in the fresh air. In the fall, the trees change color, and the leaves make the ground look like a painting. Many people come to Cheata just to enjoy its peaceful nature walks.

Visit the Local Farm Market

Every weekend, locals gather at the Cheata Farm Market. Here, you can buy fresh fruits, vegetables, homemade pies, and local crafts. It’s more than just shopping—it’s a place where the community comes together. Farmers bring in their best goods, and kids run around while adults catch up with friends.

Explore Old Buildings

Cheata has a rich history, and you can still see old buildings that have been standing for more than 100 years. Some of them have been turned into small museums or local shops. Exploring these buildings helps you learn about the town’s past and how people lived long ago. It’s a fun way to step back in time and appreciate how much the town has grown.

Who Lives in Cheata?

Cheata is home to kind, hardworking people. Most residents have lived here for many years, and many families have been here for generations. You’ll find people of all ages in Cheata—from little kids to grandparents. The town is very welcoming to newcomers, and everyone is treated like family.

In Cheata, people know each other by name. Neighbors help each other out, and kids can safely play outside. It’s a close-knit community where people feel safe and happy. You don’t have to worry about traffic, noise, or crowded streets. Life here moves at a gentle pace, and people take the time to enjoy it.

Schools and Learning in Cheata

Education is very important in Cheata. The town has a few small schools where teachers know each student by name. Because the class sizes are small, kids get more attention and help with their learning. Parents say their children love going to school because they feel safe and supported.

Cheata also has a local library that offers books, internet access, and fun reading programs for kids. Families often visit the library together, and it’s a great place for children to learn and grow. Some people in Cheata also homeschool, and the community supports every family’s choice for learning.

How to Get to Cheata

Getting to Cheata is easy, even if it feels like a hidden gem. Most people drive in from nearby cities, using the main highway that leads directly into town. The roads are well-kept, and the drive is peaceful, passing through fields and trees.

If you’re flying, the closest airport is about an hour away. From there, you can rent a car or take a local shuttle service into Cheata. Some people even bike into town, especially in the warmer months.

Weather in Cheata: What to Expect

The weather in Cheata is one of its best features. It changes with the seasons, giving you a little bit of everything.

Summer in Cheata

Summers in Cheata are warm and sunny. People spend time outdoors, swimming in lakes, having picnics, and enjoying ice cream from the local shop. Even when it gets hot, there’s always a cool breeze in the evening.

Winter in Cheata

Winters in Cheata are snowy and magical. Kids love building snowmen and sledding down small hills. The town gets quiet under a blanket of snow, and many families gather by the fire to play board games or drink hot chocolate. Streets are well-cleared, so getting around isn’t a problem.

Jobs and Work in Cheata

Most jobs in Cheata are in farming, small businesses, and local services. Some people work in nearby cities and commute each day. There are jobs in schools, healthcare, shops, and maintenance. Many residents also work from home or run their own businesses. Cheata supports local workers, and the cost of living is low, which makes it easier to enjoy life here.

The job market may not be as big as in cities, but people in Cheata appreciate the balance between work and personal life. It’s a place where your job doesn’t take over your whole day, and you still have time to relax and spend time with family.

The Bottom Line

Cheata is a small town with a big heart. It offers peace, community, nature, and a slower pace of life that many people dream of. Whether you’re looking for a place to raise a family, retire, or simply enjoy nature, Cheata could be the perfect spot.

From friendly neighbors to fun outdoor activities, Cheata has something for everyone. And the best part? It’s simple, welcoming, and easy to fall in love with.

If you’re searching for a quiet town full of charm and kindness, give Cheata a visit. You might just decide to stay.

News

Setři Smart and Save Big: A Simple Guide for Everyone

Published

18 hours agoon

July 2, 2025By

Anderson

Setři is a fun, smart, and simple way to help you save money. Whether you’re a grown-up managing bills or a kid saving up for your favorite toy, Setři makes saving easy and even exciting. In this guide, we’ll show you how Setři works, why it matters, and how anyone—even a 10-year-old—can use it to build better money habits!

What Is Setři and Why Should You Care?

Setři is a personal finance and savings tool designed to make saving money easier, smarter, and more fun for people of all ages. The name “Setři” comes from a word that means “save”—and that’s exactly what it helps you do.

You should care about Setři because it’s more than just a money app. It’s a tool that teaches you how to be smart with your cash. Instead of stressing over where your money goes, Setři helps you track your spending, build a savings plan, and reach your financial goals faster—without making it feel like hard work.

With Setři, you don’t need to be a financial expert. The platform breaks down complicated money ideas into easy steps so anyone, even beginners or young users, can understand and benefit from it. And since saving is something everyone needs to do, Setři gives you the tools to start now—no matter how small your income or allowance is.

How Setři Helps You Save Money Every Day

Setři works behind the scenes to help you find smart ways to cut spending and grow your savings. From rounding up your purchases and saving the extra change, to helping you set realistic weekly or monthly savings goals, the app makes money management simple.

Every day, Setři checks your habits and spending. If you’re spending a little too much on things like snacks, coffee, or random online buys, Setři sends you a gentle nudge. It shows you where your money is going and how you can save more—without making you feel guilty or overwhelmed.

Setři also has tools that automatically transfer small amounts of money to your savings account based on your own rules. For example, you could save $1 every time you skip a sugary drink or eat at home instead of ordering takeout. These tiny choices add up fast, and Setři helps you see the results.

Setři for Families, Kids, and Teens

Setři isn’t just for adults. It’s also great for families who want to teach their kids and teens smart money habits early. When kids learn how to manage their money in simple ways, they grow up confident and smart about spending, saving, and budgeting.

For parents, Setři makes it easy to set savings goals with your children. Whether it’s saving for a bike, a birthday gift, or a new game, Setři helps track every dollar. It also creates an environment where money talks are open and positive instead of stressful or confusing.

With features designed for younger users, kids and teens can start building the foundations of good money habits while having fun doing it.

Easy Saving Tips for Kids

- Start with a Piggy Bank or Digital Wallet: Kids love seeing their savings grow, whether in a real jar or on the screen. Setři lets them see their progress and get excited about reaching their goals.

- Earn, Then Save: Encourage kids to earn small amounts of money through chores, helping family, or doing small tasks. Then, show them how to save a part of every dollar.

- Set Fun Goals: Saving becomes exciting when there’s a reward. Setři allows kids to choose their own goal—like a toy, trip, or treat—and watch their savings grow until they get it.

Say Hello to a Weekly Budget

Creating a budget doesn’t have to be boring or complicated. With Setři, kids and teens can build a weekly plan for how they want to spend and save their money.

Here’s how it works:

- Decide how much money you have for the week (allowance, chores, gifts).

- Choose how much to save (even 10% is a good start).

- Track spending with Setři to see how well you’re doing.

Weekly budgeting builds responsibility and helps young savers make smart choices with their cash. And since Setři tracks every penny, it’s easy to stick with it.

Use Setři to Track Every Dollar

Setři makes it super easy to track money. Every dollar you earn, spend, or save is recorded and shown in a clear way. You’ll always know where your money is going and how close you are to reaching your goals.

With fun visuals, easy-to-read charts, and automatic updates, Setři helps kids and teens stay on top of their finances without getting lost in boring spreadsheets or confusing terms.

Cool Ways Kids Can Learn to Save Too

Kids learn best when saving feels like a game. Setři offers fun and creative tools that turn saving into a challenge, a race, or even a team effort with friends or family.

For example, kids can:

- Set a 30-day goal to save for a toy

- Compete with siblings to see who saves more

- Earn badges and rewards for hitting milestones

The more they save, the more motivated they feel. And because Setři shows their progress in real-time, every step forward feels like a win.

Saving doesn’t need to feel like something you have to do. With Setři, it’s something you want to do.

How to Make a Money Plan With Setři

A money plan is just another way to say “budget.” It’s a smart idea for anyone—adults, teens, and kids—to know how much money is coming in, how much is going out, and what’s left to save.

Setři walks you through the process in three easy steps:

- Know Your Income: This could be your job, allowance, or side hustle.

- Track Your Expenses: Use Setři to watch what you’re spending each day.

- Set a Savings Goal: Decide what you want to save for and how much.

Once you’ve got a plan, Setři reminds you to stick with it. It keeps you on track, motivates you, and even celebrates your wins along the way.

Make Saving a Fun Game (Yes, Really!)

Saving money doesn’t have to be boring. Setři turns saving into something fun and exciting that you’ll actually want to do. Here are a few fun ideas to try:

Try a No-Spend Challenge

Challenge yourself or your family not to spend any money for a whole day—or even a whole week! Instead of going out or shopping, try:

- Free activities at home

- Cooking your own meals

- Playing games or doing crafts

Setři keeps track of the money you didn’t spend and helps you save it toward your next big goal.

Reward Yourself the Smart Way

When you hit a savings goal, reward yourself with something meaningful—but still within your budget. For example:

- A new book or small treat

- An outing with friends

- A family game night

Setři helps you create reward goals and builds a sense of accomplishment. Saving doesn’t have to feel like a chore—it can feel like winning.

Skip the Small Stuff That Adds Up

It’s amazing how small things like daily snacks, drinks, or in-app purchases can add up over time. Setři shows you exactly how much these little things cost you in a month.

By skipping just one $5 expense every day, you could save $150 a month! That’s the power of knowing your habits—and Setři helps make those smarter choices every day.

Tips to Save Smarter With Setři

Saving smart doesn’t mean giving up all the fun. It just means making better choices—and Setři is here to help with that.

Start by tracking your spending honestly. Don’t hide or guess. Then, use Setři to set goals that make sense for you. Even if you’re saving just $1 per day, it adds up to $365 a year!

The more you use Setři, the better it gets at giving you personal tips and nudges. You’ll start to notice patterns, like where you overspend and where you can save more. Over time, these little changes make a big difference.

The Bottom Line

Setři is not just another savings app—it’s your personal money coach, guide, and cheerleader. Whether you’re a parent teaching your kids about money or a teen saving for your first big purchase, Setři makes the process simple and fun.

It’s built for real life. You don’t need to be rich or perfect to start saving. All you need is the desire to be smarter with your money—and a tool like Setři to help you every step of the way.

News

Why the Bank of America Got in Trouble: BSA Problems Explained Simply

Published

19 hours agoon

July 2, 2025By

Anderson

Every bank in the United States must follow rules to stop bad money—like drug or terror money—from moving through the system. Bank of America, one of the biggest banks in the country, got in trouble recently for not following these rules properly. This article will explain why it happened and what it means for everyday people.

What Does BSA Mean and Why Should We Care?

The Bank Secrecy Act, or BSA, is a law made back in 1970. It helps stop criminals from hiding illegal money in the banking system. Think of it as a security guard for our money system. It makes sure banks check where money is coming from and where it’s going. The goal is to catch things like money laundering, terrorist funding, and fraud before they cause damage.

Banks have to file reports when they see strange activity. For example, if someone deposits $10,000 in cash often, the bank should check it out and maybe report it. These reports help the government catch crimes. If a bank doesn’t follow the BSA, it could let criminals hide money easily—and that’s a big risk for all of us.

Who Are the OCC and What Do They Do?

The Office of the Comptroller of the Currency (OCC) is a part of the U.S. Treasury Department. They make sure banks are doing their jobs right. The OCC watches over national banks like Bank of America, checking if they follow laws like the BSA.

The OCC looks at whether a bank has strong systems in place to stop crime. If a bank isn’t doing enough, the OCC can take action. They can fine the bank, give warnings, or even stop it from doing certain business until things are fixed.

What Went Wrong at Bank of America?

Bank of America got into trouble because the OCC found several problems with how it handled BSA rules. These weren’t small mistakes—they were serious deficiencies that had been going on for years.

The OCC said Bank of America didn’t have a strong enough system to detect money laundering and other suspicious activities. This can let bad actors move money without being caught.

Let’s break down the main issues that the OCC found.

Missing Checks on Bad Money

One of the most important parts of the BSA is monitoring suspicious transactions. Bank of America was supposed to catch red flags, like large or strange money movements. But the OCC said the bank missed many of these checks. That means illegal money could’ve flowed through the bank without anyone noticing.

This happened because the systems Bank of America used to find suspicious transactions weren’t working well enough. They either didn’t spot the problems or didn’t flag them in time. That’s a big issue, especially for one of the largest banks in the world.

Weak Systems and Mistakes

Another issue was the technology and systems the bank used. The OCC found that Bank of America had weak tools for spotting illegal activity. Imagine trying to find a needle in a haystack with your eyes closed—that’s how bad the systems were.

Also, some of the manual processes used by staff were outdated or just wrong. Mistakes happened in how they recorded and reviewed customer transactions. These errors made it even harder to detect illegal actions.

Not Enough Staff to Handle Alerts

Even when the system did raise red flags, there weren’t enough people to look into them. The OCC reported that Bank of America didn’t have enough trained employees to handle the huge number of alerts from suspicious activity.

Without proper staff, the alerts would pile up and go uninvestigated. This creates blind spots in the system and allows illegal transactions to slip by unnoticed.

What Happens When a Bank Breaks BSA Rules?

When a bank doesn’t follow BSA rules, it faces serious consequences. First, regulators like the OCC can issue something called a consent order. That’s like a warning letter that says: “Fix your problems or else.”

If the bank ignores the issues or doesn’t improve quickly, it can be fined millions—or even billions—of dollars. In the past, banks have had to pay huge penalties for similar violations.

For Bank of America, the OCC issued a formal consent order in 2024, demanding the bank fix its compliance systems. This doesn’t mean the bank is guilty of a crime, but it means the problems are big enough that the government had to step in.

What Bank of America Needs to Do Now

Now that the OCC has stepped in, Bank of America must act fast. It needs to upgrade its systems, train more staff, and make sure all rules are followed every single day.

The bank will also need to review old transactions to find any that were missed. If they find suspicious activity that wasn’t reported before, they must file reports right away.

On top of that, the bank has to work closely with the OCC to show progress. This means regular check-ins, submitting reports, and showing proof that their compliance program is getting better.

How This Affects People Like Us

You might wonder, “I’m just a regular person—how does this affect me?” Well, the answer is: it does, in several ways.

Bank May Get More Careful

To avoid more trouble, Bank of America will now look more closely at all transactions. That means you might notice more questions about your deposits, especially if they’re in cash or from overseas. The bank isn’t trying to bother you—they’re trying to avoid breaking the rules again.

Longer Wait Times

Because the bank has to check more things and follow stricter rules, it could lead to longer wait times when opening new accounts or transferring large amounts of money. They might also freeze accounts temporarily while they verify activities.

This is frustrating, but it’s meant to protect the whole banking system.

Can Other Banks Make the Same Mistake?

Yes. Bank of America isn’t the first big bank to get in trouble under the BSA—and it won’t be the last. In the past, banks like Wells Fargo, Citigroup, and HSBC have all faced penalties for BSA or AML (Anti-Money Laundering) issues.

This shows that no bank is too big to fail at compliance. The rules apply to all banks equally, and regulators are watching closely.

Thoughts — Why This Story Matters

This story matters because banks are a part of our everyday lives. We use them to save money, pay bills, and receive our salaries. If banks aren’t safe or don’t follow rules, it puts our money—and the whole economy—at risk.

The BSA is there to protect us from things we can’t always see, like money laundering or terrorist financing. When big banks like Bank of America fall short, it’s a warning sign for everyone. It shows why strong oversight, smart systems, and enough trained staff are important to keep the system working safely.

The Bottom Line

Bank of America got in trouble with the OCC because it didn’t do a good job of stopping suspicious money activity. The bank had weak systems, not enough staff, and missed warning signs—all of which are serious BSA violations.

Now, the bank must fix these problems or face bigger consequences. While these changes may slow down some banking services, they are important to protect the financial system from crime.

As customers, it’s good to know what’s happening. The more we understand about how banks are supposed to work, the better we can protect ourselves and our money. Always ask questions and stay informed—because when banks follow the rules, everyone benefits.

What Is Cheata? A Simple Guide for Everyone

Setři Smart and Save Big: A Simple Guide for Everyone

Why the Bank of America Got in Trouble: BSA Problems Explained Simply

TuGuiaUSA.com, Empleos y Oportunidades en USA

Camille Monfort, Shadows of the Crimson Moon

Breaking News: Tea Leoni and Tim Daly Announce Split

Trending

-

Business6 months ago

Business6 months agoTuGuiaUSA.com, Empleos y Oportunidades en USA

-

Life Style7 months ago

Life Style7 months agoCamille Monfort, Shadows of the Crimson Moon

-

Life Style7 months ago

Life Style7 months agoBreaking News: Tea Leoni and Tim Daly Announce Split

-

Games6 months ago

Games6 months agoUnlocking Access to Unblocked Games World at School

-

Life Style7 months ago

Life Style7 months agoJulio Urias Wife: Inside His Life with Daisy

-

Life Style6 months ago

Life Style6 months agoIgAnony: The Anonymous Instagram Story Viewer

-

Technology11 months ago

Technology11 months agoGeekzilla Radio – Your Ultimate Geek Culture Nexus

-

Life Style7 months ago

Life Style7 months agoMichael Ciminella: Biography, Age, Net Worth & Career Highlights